Morgan Stanley 2023 Investment Outlook

Michael Wilson from Morgan Stanley, the No 1 rated portfolio strategist in 2022, recently provided his outlook for 2023. He believes the market has further downside to go.

Fire and Ice

Fire is inflation, and Ice is slowing growth. Together, they are pretty toxic, and when ice takes over the fire, they are more confident that bonds will beat stocks in this final phase that has yet to play out.

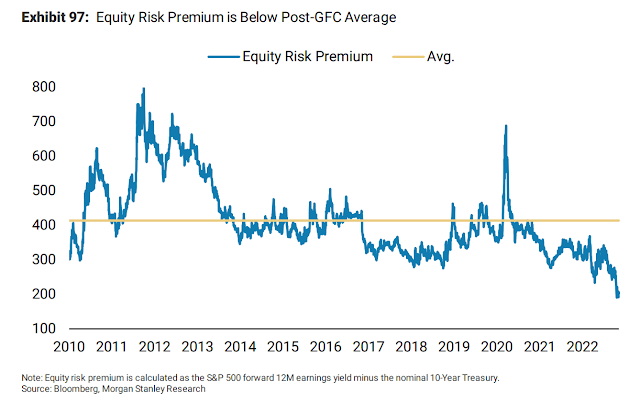

The ratio of equity to bond may show that bonds may outperform stocks.

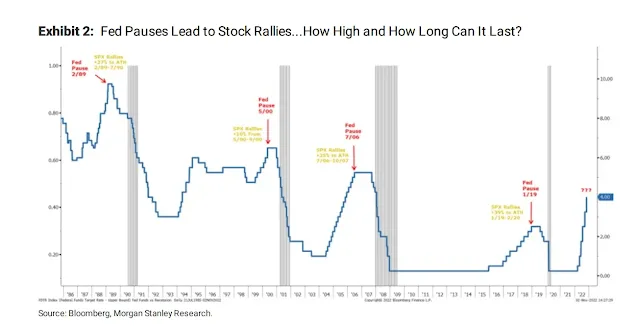

Subsequent Rate Cuts Matches Recession and Further Equity Downsides

Equities usually have ways to fall while Fed is still cutting rates (Exhibit 3)

EPS Growth Likely to Go Further Negative

Morgan Stanley’s leading earnings model was seldom wrong when viewed over the longer term. There were some short-term timing issues.

But the gap between indicator and actual S&P 500 last twelve months growth has never been this wide since 2008.

During periods of high inflation (CPI) the fall in earnings tends to be bigger. When the cost of goods sold + SGA expenses are positive (cost more than sales), the net income growth tends to be negative. The inverse relationship between net income growth and cost is there.

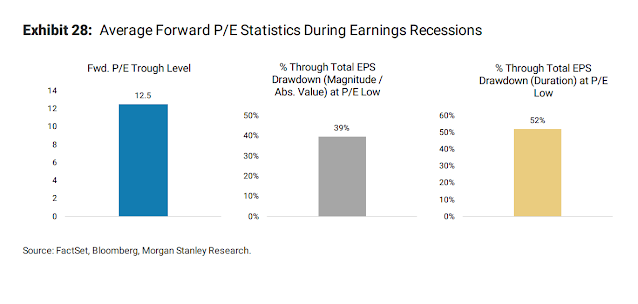

Whether the scenario is pessimistic or optimistic, the EPS should come down, and based on reasonable P/E, the price target ranges between 3,500 to 4,200 for the S&P 500.

The average PE during earnings recessions: is 12.5 times. We have much to go.

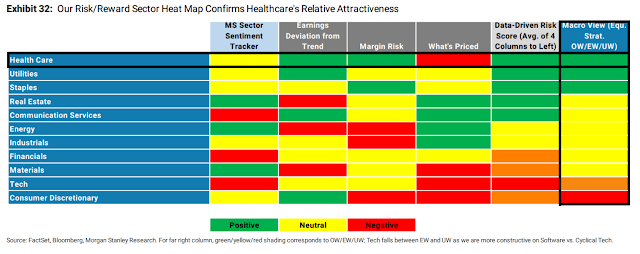

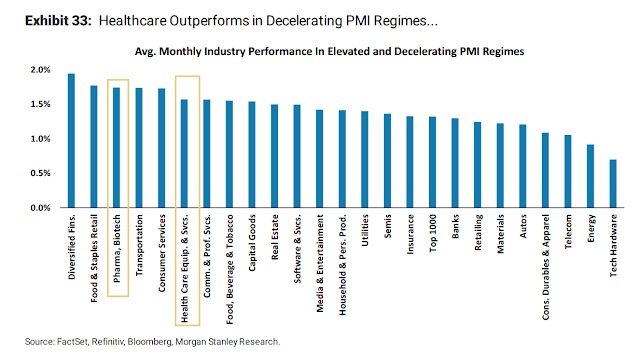

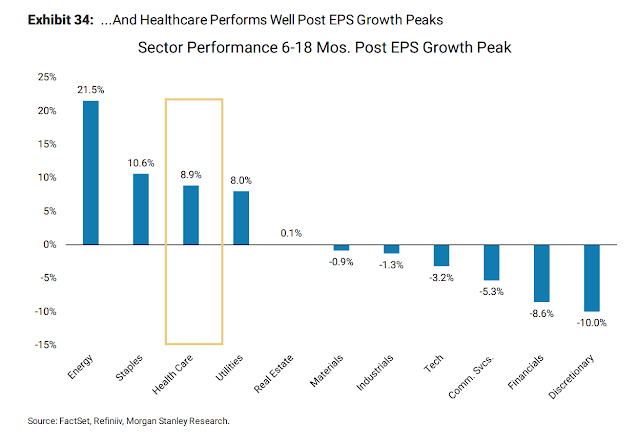

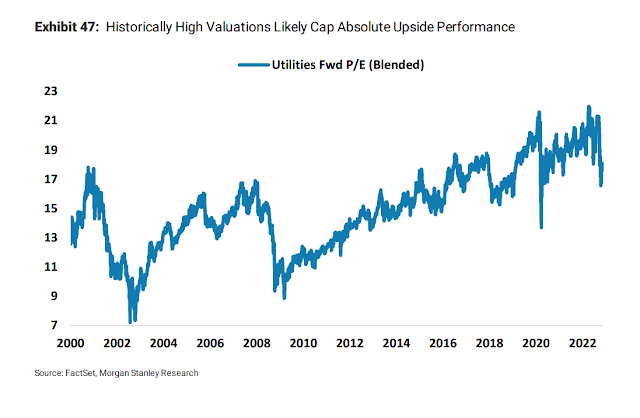

Sector Preferences – Healthcare, Consumer Staples and Utilities

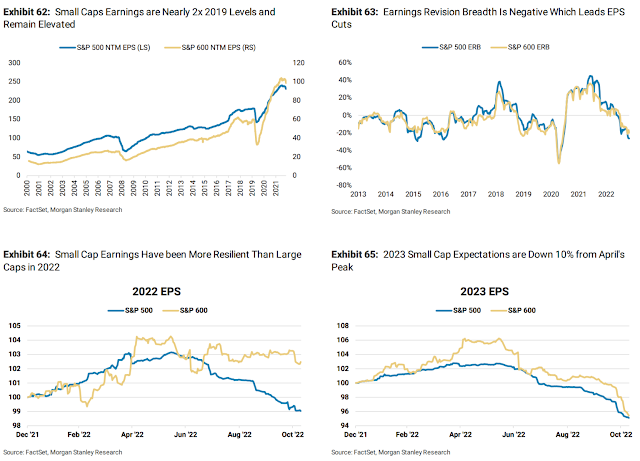

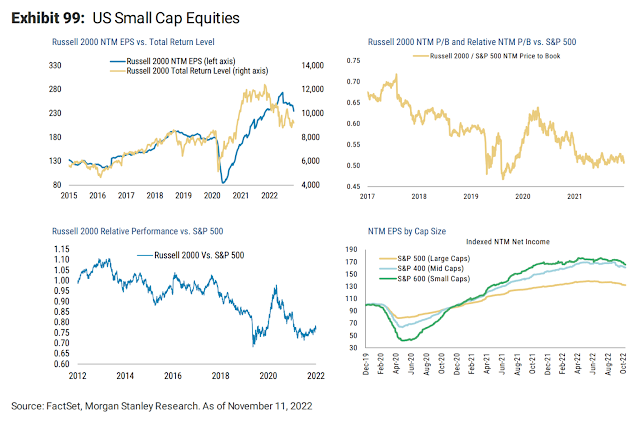

Small Cap Valuation and Performances

Small cap valuation, using P/E is cheaper relative to history and against the large cap.

0 comments